Testimonials & Case Studies

Call: 0800 0016 878 - Email: info@thetaxfaculty.co.uk

(Non-UK callers may need to call +44 207 101 3845 if you cannot connect to our 0800 number)

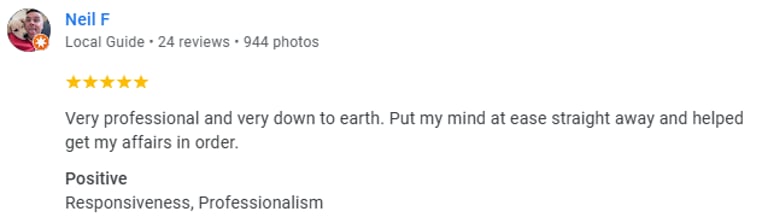

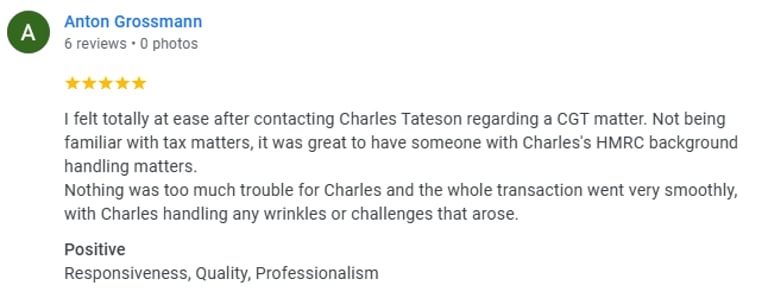

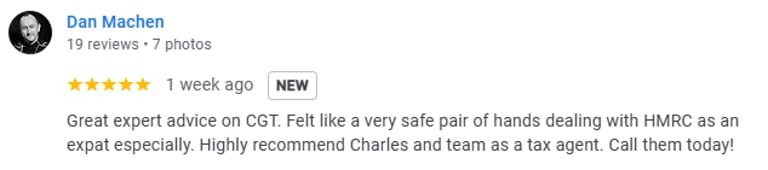

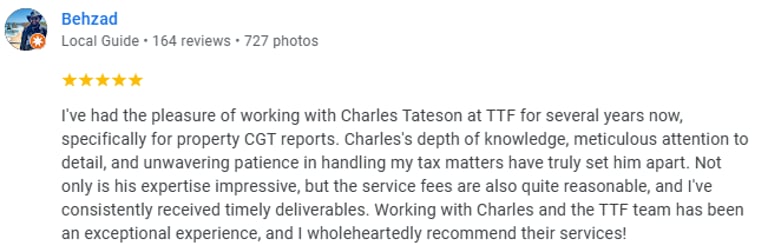

The reviews provided by our clients show just how we can assist you with your tax matters, taking the stress away and being there every step of the way

We do everything for you, including filing returns and giving advice that may help to reduce the amount of tax that you owe.

Our guarantee to you - You will pay the lowest amount of tax possible, while complying with the law.

”This is absolutely amazing news and I/we cannot thank you enough. Thanks once again for your invaluable assistance””

Mrs R - UK

CGT Property Advice Case Study One

We were approached by Mrs R to represent her elderly parents in dealing with all aspects of Capital Gains Tax on the disposal of a family property. Mrs R was extremely worried as her parents suffered terribly from health issues which were severely affecting their ability to cope with the stress of the situation.

We took a proactive approach and ensured agreement with HMRC that client’s parents were “digitally excluded” due to ill health and disability, enabling us to file paper returns.

We then took full responsibility for preparing Capital Gains Tax computations and filing these with HMRC, as well as producing a detailed Advisory Report for the client to explain exactly why we took the views that we did, all backed by tax statue - which was also included in the Report for ease of reference for the client.

Initial views from clients were that they were facing a tax bill of over £11,000 each and this was reduced to just over £2,000 each, entirely within the statute governing Capital Gains Tax.

All Capital Gains Tax returns were filed within the 60 day limit and the client praised our professional yet caring and sensitive approach to her parents.

our client said:

"I was given very clear and helpful advice. The person who dealt with my queries was generous with his time and happy to go over things with me. The fees charged were totally affordable and all in all I can recommend the Tax Faculty for excellent service and value for money."

Tax Troubles? Contact us Today

How We Work

Step One

We start with a completely free and confidential consultation. This can take place by way of a meeting (over the telephone, video meeting or in person) or by way of email. We get to know you, your circumstances and your requirements.

Step Two

We analyse your situation and your needs in order to identify how best we can assist you. This might involve filing tax returns on your behalf with HMRC, providing advice on reducing your tax liability now and in the future, or a combination of such work.

Step Three

Should you wish to engage us, we would provide you with a fixed fee quote for the work required to solve all of your tax worries. We then complete our work with the highest levels of professionalism, keeping you updated at every stage and taking the stress away.

Why Choose Us?

The Tax Faculty LLP

The Others

Specialist, Proactive

In-House Tax Team

Free Consultations & Calls

Fixed Fees

Aftercare Included

We prefer to get to know you and your circumstances during a free consultation so that we can identify how best to assist you.

Over £225 for 30 minutes on the telephone

You will have a dedicated Tax Faculty LLP Tax Specialist to assist you with everything that you need. No bots, no online forms. We prefer the human touch.

Reviews say that they were unhappy that they were sent to an external person who simply told them to fill in an online form with figures

We aren't just accountants - we're Tax Professionals with years of experience working for HMRC and working for clients like you. We provide advice to reduce tax bills and solve complex problems.

Service is limited to filing tax returns unless you pay more fees for additional consultations which work out at over £450 per hour.

Once we've identified how best to assist you, we provide a fixed fee quote to carry our the work on your behalf. You will be safe in the knowledge that you will never pay more than this fixed fee.

If more time or advice is needed, you pay more. This leads to unexpected and high fees being paid.

Each of our clients are provided with HMRC Fee Protection Insurance, meaning that if HMRC ask any questions, we respond on your behalf - with no added fees being charged to you.

If HMRC ask questions in relation to your tax affairs - guess what? That's right, you pay an added hourly fee for any replies to be written.

Tax Advice

Contact Us

Contact us today on freephone 0800 0016 878 for a free consultation on all Capital Gains Tax issues, or fill out the handy form below and we'll get back to you as soon as possible.

Alternatively, you can email us at info@thetaxfaculty.co.uk or complete the handy form below.

(Please note, non-UK callers may need to call 0207 101 3845 if your line cannot connect to our 0800 number)

Feel free to contact us through WhatsApp - we accept calls and messages.

Simply click the WhatsApp button below: